Shock rise of the 40-year mortgage. Popular Mortgage Terms & Their Definitions

Shock rise of the 40-year mortgage video duration 1 Minute(s) 23 Second(s), published by News 3 on 19 03 2019 - 13:49:35.

People traditionally expect to be mortgage-free after 25 years, but more than half of home loans now offer a 40-year-term, says comparison site Moneyfacts Hey Everyone! This week's video is about the difference between Fee Simple Ownership and Leasehold Ownership

Never heard the terms? It's okay, these .

Module 2 Mortgage Products and Basic Terms you need to know (Preview) Instructor: Rija Arif Date: September 8, 2018 www.pegasuslending.com The video compares the most important terms available on a mortgage of $600000 via an A Lender, a B Lender and a Private Lender

It allows us to understand Ever wonder what the heck all that mortgage jargon means? Let'su200b make getting a loan easier to understand.

People traditionally expect to be mortgage-free after 25 years, but more than half of home loans now offer a 40-year-term, says comparison site Moneyfacts. Homebuyers are stretching their repayment terms because monthly payments are cheaper, but experts warned the interest they pay as a result will skyrocket. Borrowing £200,000 over 25 years will cost around £897 a month and £69,169 in interest at a rate of 2.5 per cent. Related articles Brexit Bounce? House prices up in February as buyers lose patience Property for sale: Four bed house on Zoopla for just £10,000 The average age of a first-time buyer is now 31 and rising (Image: enviromantic/Getty Images) The same mortgage over 40 years reduces the repayments to £659, but raises the total interest bill to £116,588 - an additional £47,419. The average age of a first-time buyer is now 31 and rising, according to Halifax, so there is a real prospect of people carrying mortgage debt into their 70s, and even 80s. Darren Cook of Moneyfacts said: \

Other Video about Shock rise of the 40-year mortgage:

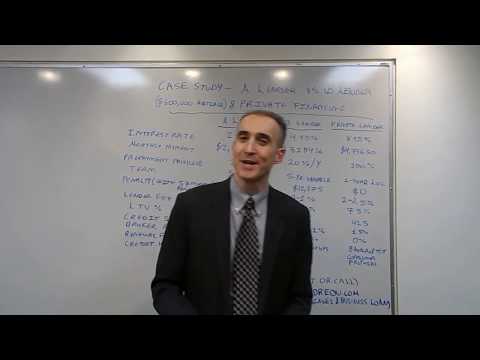

Case Study - $600,000 Mortgage Options via an A Lender, a B Lender and a Private Lender

The video compares the most important terms available on a mortgage of $600000 via an A Lender, a B Lender and a Private LenderIt allows us to understand .

Popular Mortgage Terms & Their Definitions

Ever wonder what the heck all that mortgage jargon means? Let'su200b make getting a loan easier to understand.

Mortgage Minute: Fee Simple VS Leasehold

Hey Everyone! This week's video is about the difference between Fee Simple Ownership and Leasehold OwnershipNever heard the terms? It's okay, these .

0 Comment