📚 How to calculate monthly mortgage amortization payments (Question 2). 📚 How to calculate monthly mortgage amortization payments (Question 3)

📚 How to calculate monthly mortgage amortization payments (Question 2) video duration 7 Minute(s) 34 Second(s), published by Study Force on 18 10 2017 - 22:16:35.

Brought to you by: https://StudyForce.com 🤔 Still stuck in math? Visit https://StudyForce.com/index.php?board=33.0 to start asking questions

Question: Joe has a https://gp1pro.com/USA/FL/Bay/Panama_City/Panama_City_Florida/BEACH_DRIVE.html Mortgage Amortization Calculator Panama City CLICK THIS LINK .

. http://www.AmazingAmort.com Example of amortization with extra monthly plus lump payment saves thousands in interests on a home loan

Visit http://www Brought to you by: https://StudyForce.com 🤔 Still stuck in math? Visit https://StudyForce.com/index.php?board=33.0 to start asking questions

Q

Determine the .

🌎 Brought to you by: https://StudyForce.com

🤔 Still stuck in math? Visit https://StudyForce.com/index.php?board=33.0 to start asking questions.

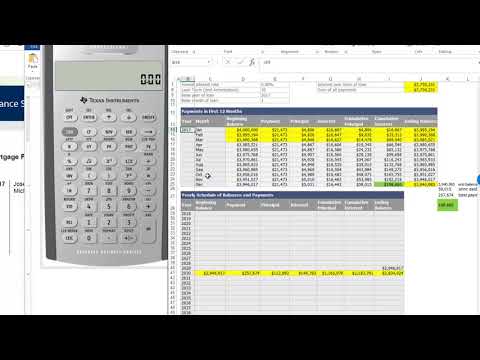

Question: Joe has a $398,000 mortgage. He locks in at 4.3% interest, compounded semi-annually, amortized for 20-years.

a) Calculate his monthly mortgage payments.

b) What percent of the total paid is interest?

What you'll need:

Present value (PV)

PV=R[〖1−(1+i)〗^(−n) ]/i → solving for R gives us → R=(PV∙i)/[〖1−(1+i)〗^(−n) ]

Where:

PV=present value amount

R=regular deposit/payment

i=interest rate per compounding period

n=total number of deposits

Since you're making monthly payments, yet the interest is being compounded semi-annually, there is a discrepancy between when payments are made and when interest is compounded. As a result, we'll need to find the effective annual rate (EAR), then use the EAR to find the effective monthly rate (EMR). This will represent the interest, i, in the PV formula.

Summary: Combining the EAR and EMR formula:

i=(1+r/m)^(m/12)−1

Where:

i=interest rate per compounding period

r=rate provided per compounding period

m=frequency of compounding

Effective annual rate (EAR)

Converts a monthly rate to an effective annual rate.

k=(1+r/m)^m−1

Where:

k=Effective annual rate

m=frequency of compounding

r=rate in decimal

Effective monthly rate (EMR)

Converts an effective annual rate to a monthly one.

i=(k+1)^(1/12)−1

Other Video about 📚 How to calculate monthly mortgage amortization payments (Question 2):

Amortization: Save money with extra payments on home loan

http://www.AmazingAmort.com Example of amortization with extra monthly plus lump payment saves thousands in interests on a home loanVisit http://www.

📚 How to calculate monthly mortgage amortization payments (Question 3)

Brought to you by: https://StudyForce.com 🤔 Still stuck in math? Visit https://StudyForce.com/index.php?board=33.0 to start asking questionsQ

Determine the .

Mortgage Amortization Calculator Panama City

https://gp1pro.com/USA/FL/Bay/Panama_City/Panama_City_Florida/BEACH_DRIVE.html Mortgage Amortization Calculator Panama City CLICK THIS LINK .

0 Comment