What is the math formula for mortgage payments? Mortgage Sales Manager. Mortgage Payment, Retirement Plan

What is the math formula for mortgage payments? Mortgage Sales Manager video duration 2 Minute(s) 23 Second(s), published by Mortgage Sales Manager on 11 08 2017 - 16:46:11.

What is the math formula for mortgage payments? This video is designed to help mortgage loan officers learn the right way to calculate the mortgage math Related Example: https://www.youtube.com/watch?v=tOrgX8Jw4is&list=PLJ-ma5dJyAqoPY3wzCKZBw5ZFlYo-tZmb&index=2 Part B: .

. Petition and more information: http://interes.ax5.org/ Compound interest is the only interest rate used in serious finances

It allows to compare products and to Instead of using the retirement plan formula A = PMT [((1+(APR/n))^(ny)-1)/(APR/n)], and you can see it is very complex, you can use the TVM solver in the Ti84 .

What is the math formula for mortgage payments? This video is designed to help mortgage loan officers learn the right way to calculate the mortgage math formula to show their customers how much money they're saving by refinancing. Presented by Dave King with Mortgage Sales Manager, the video begins by noting the fact that most loan officers only look at the difference in payments. While the payment amount is important to customers, it's not the best way to convey how much money someone is saving. Showing a payments-to-payments comparison is like an apples-to-oranges comparison.

There will be a different amount of time remaining on the loan, starting loan amount, interest rate, and different amortization. The most accurate formula for how much is being saved on a refinance is the amount that they owe times the interest rate differential. This formula will give you the first year's savings and the savings will go down with the balance every year after that. For example, consider a $300,000 loan at 4% versus a $300,000 loan at 3.5%. Running the numbers, the difference is $173 a month. Unfortunately, many loan officers will tell their customers that this is how much they're saving. But when using the formula provided, the difference comes to $3000 a year or $250 per month. That difference between the $173 and $250 is additional amortization that happens in the earlier years of the loan. So take the time to check the numbers, maybe run an amortization schedule or two, to help you be better able to drive home the point and express the savings to your customers.

Learn More at: http://mortgagesalesmanager.com

Subscribe to our training info: http://www.mortgagesalesmanager.com/subscribe/

Visit Us Today:

Mortgage Sales Manager

400 Inverness Parkway #160

Englewood, CO 80112

(303) 405-6400

#whatisthemathformulaformortgagepayments

#whatisthemathformulaformortgage

#mathformulaformortgagepayments

#mortgagepayments

#mortgage

#payments

#mortgagemathformula

#formula

#mortgagemath

#whatis

Other Video about What is the math formula for mortgage payments? Mortgage Sales Manager:

My mortgage monthly payment is miscalculated

Petition and more information: http://interes.ax5.org/ Compound interest is the only interest rate used in serious financesIt allows to compare products and to .

Mortgage Payment, Retirement Plan

Instead of using the retirement plan formula A = PMT [((1+(APR/n))^(ny)-1)/(APR/n)], and you can see it is very complex, you can use the TVM solver in the Ti84 .

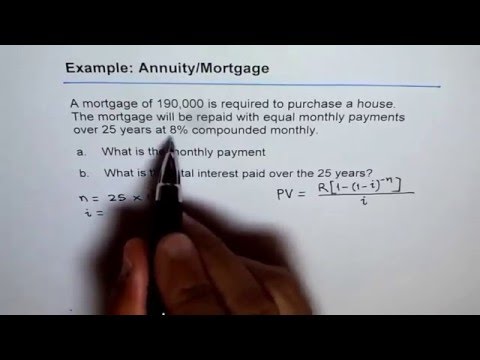

Calculate Monthly Payments For Mortgage or Annuity Part A

Related Example: https://www.youtube.com/watch?v=tOrgX8Jw4is&list=PLJ-ma5dJyAqoPY3wzCKZBw5ZFlYo-tZmb&index=2 Part B: .

0 Comment