Who Is Buying Up the Toxic Mortgage Backed Securities (MBS) That The Fed Is Selling?.

Who Is Buying Up the Toxic Mortgage Backed Securities (MBS) That The Fed Is Selling? video duration 16 Minute(s) 55 Second(s), published by WallStForMainSt on 16 07 2019 - 17:28:01.

The Fed is still doing QT and just dumped a record amount of mortgaged backed securities (MBS) of $30 billion dollars in a single month

But who's buying the Il trader Will Emerson ha il compito di vendere centinaia di milioni di dollari di titoli di debito collateralizzati entro la chiusura della seduta, anche a costo di .

Subscribe and Comment to win a chance at getting a BobMortgage Yeti The Mortgage Report: Mortgage-backed securities are trading at the top of the range, Our MCT community webinar reviewed Graystone Mortgage, an MCT client that achieved significant ROI through outsourcing strategies implemented with the

The Fed is still doing QT and just dumped a record amount of mortgaged backed securities (MBS) of $30 billion dollars in a single month. But who's buying the toxic MBS?

Recent Wolf Richter article about the Fed dumping record amounts of MBS: Forget Rates, The Fed Is Still Quantitative-Tightening At A Record Pace https://www.zerohedge.com/news/2019-07-06/forget-rates-fed-still-quantitative-tightening-record-pace

Articles about Private Equity firms like Blackstone and large banks buying up foreclosures post 2009 (with artifically cheap capital and credit) and now building and managing single family rentals (SFRs):

1) How to Buy a House the Wall Street Way https://www.wsj.com/articles/how-to-buy-a-house-the-wall-street-way-1537102800

2) A brand new single-family neighborhood, where every unit is a rental https://www.curbed.com/2018/9/10/17824802/single-family-rental-communities

3) Wall Street’s new housing frontier: Single-family rental homes https://www.curbed.com/2018/5/18/17319570/wall-street-home-rentals-single-family-homes-invitation

4) Your New Landlord Works on Wall Street https://newrepublic.com/article/112395/wall-street-hedge-funds-buy-rental-properties

5) Blackstone to buy $1 billion worth of Tampa Bay homes for rentals https://www.tampabay.com/news/business/realestate/blackstone-to-buy-1-billion-worth-of-tampa-bay-homes-for-rentals/1252624

6) Blackstone Buys Atlanta Homes in Largest Rental Trade https://www.bloomberg.com/news/articles/2013-04-25/blacktone-buys-atlanta-homes-in-largest-bulk-rental-trade

Please visit the Wall St for Main St website here: http://www.wallstformainst.com/

Follow Jason Burack on Twitter @JasonEBurack

Follow Wall St for Main St on Twitter @WallStforMainSt

Commit to tipping us monthly for our hard work creating high level, thought proving content about investing and the economy https://www.patreon.com/wallstformainst

Also, please take 5 minutes to leave us a good iTunes review here! We only have about 51 5 star iTunes reviews and we need to get to our goal of 100 5 star iTunes reviews asap! https://itunes.apple.com/us/podcast/wall-street-for-main-street/id506204437

If you feel like donating fiat via Paypal, Bitcoin, Gold Money, or mailing us some physical gold or silver, Wall St for Main St accepts one time donations on our main website.

Wall St for Main St is also available for personalized investor education and consulting! Please email us to learn more about it! If you want to reach us, please email us at: wallstformainst@gmail.com

**DISCLAIMER- ANYTHING MENTIONED DURING THIS AUDIO OR SHORT VIDEO RECORDING IS FOR INFORMATION & EDUCATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT ADVICE. JASON BURACK AND HIS GUESTS ARE MERELY STATING THEIR OPINIONS ON DIFFERENT TOPICS RELATED TO INVESTING, THE ECONOMY, MARKETS OR COMPANIES. PLEASE TALK TO YOUR INVESTMENT ADVISOR AND DO ADDITIONAL RESEARCH AND DUE DILIGENCE ON YOUR OWN BEFORE INVESTING AND MAKING IMPORTANT INVESTMENT DECISIONS.- DISCLAIMER**

Other Video about Who Is Buying Up the Toxic Mortgage Backed Securities (MBS) That The Fed Is Selling?:

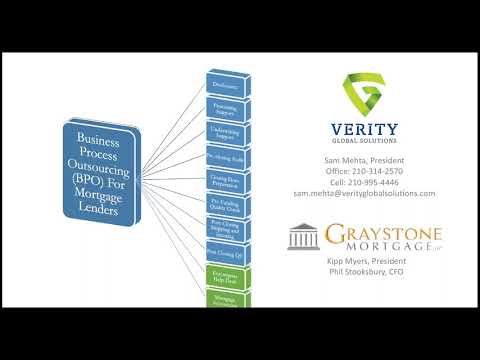

MCT Community Webinar - Outsourcing Mortgage Operations

Our MCT community webinar reviewed Graystone Mortgage, an MCT client that achieved significant ROI through outsourcing strategies implemented with the .

Margin Call (2011) - Vendita dei mortgage backed bonds (Investment Bank Trading) ITA

Il trader Will Emerson ha il compito di vendere centinaia di milioni di dollari di titoli di debito collateralizzati entro la chiusura della seduta, anche a costo di .

0 Comment