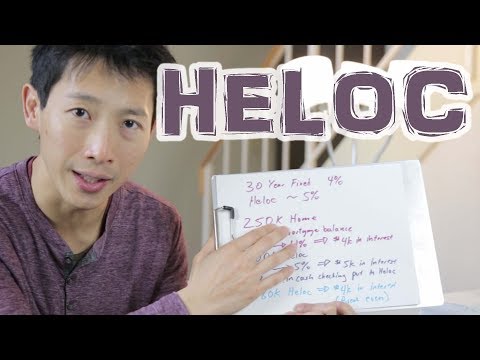

Should You Refinance To A Heloc Or Traditional Mortgage. Requirements For A Home Equity Line Of Credit (HELOC)?

Should You Refinance To A Heloc Or Traditional Mortgage video duration 1 Minute(s) 4 Second(s), published by Replace Your Mortgage on 15 11 2015 - 17:10:17.

This FREE book reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/2fi7xcs Subscribe to our channel http://bit.ly/RYM-YT Thinking

A Video that describes why it might be better to take a Home equity Conversion Mortgage (HECM) versus a Home Equity Line of Credit (HELOC). You can use the equity in your home to get a home equity line of credit

Subsequently, you can use the funds to pay of your mortgage early while then using the Free book reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/2g7XSCH Subscribe to our channel http://bit.ly/RYM-YT What are the .

This FREE book reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/2fi7xcs

Subscribe to our channel http://bit.ly/RYM-YT

Thinking of refinancing your home? Find out if you should get a home equity line of credit aka heloc or get a traditional mortgage loan.

Other Video about Should You Refinance To A Heloc Or Traditional Mortgage:

Should You Pay Off Your Mortgage Early with a HELOC?

You can use the equity in your home to get a home equity line of creditSubsequently, you can use the funds to pay of your mortgage early while then using the .

Requirements For A Home Equity Line Of Credit (HELOC)?

Free book reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/2g7XSCH Subscribe to our channel http://bit.ly/RYM-YT What are the .

0 Comment