How to pay off a 30 year home mortgage in 5-7 years. Home Mortgage/Equity/Heloc

How to pay off a 30 year home mortgage in 5-7 years video duration 29 Minute(s) 13 Second(s), published by Laura Pitko on 15 11 2017 - 05:49:35.

SUMMARY: In the above video I reveal a powerful strategy that is practically available to all, but is known and fully understood by a very few

If one takes the time In this Replace Your Mortgage review, Elliot shares how he leveraged the RYM strategy to pay off half of his home extremely quickly.and start using his line of .

In this video Michael Lush answers the question as to why this isn't as popular with banks

The answer might shock you

Also, Replace Your Mortgage Client Jay You can use the equity in your home to get a home equity line of credit

Subsequently, you can use the funds to pay of your mortgage early while then using the

SUMMARY:

In the above video I reveal a powerful strategy that is practically available to all, but is known and fully understood by a very few. If one takes the time to learn and implement this method of eliminating debt, one may find themselves pleasantly surprised of how quickly their home mortgage, auto loans, student loans or business loans can be completely paid off.

This strategy is known as Velocity Banking and in the video I will demonstrate how Velocity Banking can be used to pay off a 30 year home mortgage in just 5-7 years without sending double payments to the bank or changing one’s current level of income.

RECAP OF THE VIDEO:

I start off by creating a scenario of a financial situation by taking an average household net income in the United States combined with some of the basic monthly expenses: home mortgage, minimum payment on a credit card, car payment and living expenses which include groceries, utilities, gym membership…

Once all expenses are identified and subtracted from the net monthly income it is important to understand the impact of cash flow, the difference between a loan and a line of credit, how the interest of a loan and a line of credit is calculated, and how monthly payments on a mortgage are dispersed between interest and principal paydown. To help demonstrate these differences I create tables and an amortization graph. As I go on to unveil the main differences I also identify the biggest reason why nowadays most homeowners are unable to payoff their home mortgages due to the unstrategic use of home refinancing.

By this point having had identified the difference between a loan and a line of credit I can reveal the benefits of utilizing a line of credit to pay off a home mortgage in 5-7 years. This is where I get into the Velocity Banking strategy which incorporates an unaccustomed method of moving one’s entire monthly paycheck into a line of credit instead of the accustomed checkings and savings accounts. By adopting this method one can leverage a line of credit to free up cash flow, gain cash back rewards, build credit history and improve credit score, but the greatest leverage created is the thousands if not hundreds of thousands of dollars in interest savings.

KARL'S MORTGAGE CALCULATOR APP:

https://itunes.apple.com/us/app/karls-mortgage-calculator/id1025852681?mt=8

Android version: https://play.google.com/store/apps/details?id=com.drcalculator.android.mortgage

★☆★ SUBSCRIBE TO MY YOUTUBE CHANNEL FOR VIDEOS ABOUT REAL ESTATE AND BUSINESS ★☆★

► Velocity Banking & Real Estate Investing Course - Please email me at Laura@epcinvestments.com for more information.

★☆★ CONNECT WITH ME ON SOCIAL MEDIA ★☆★

FACEBOOK: https://www.facebook.com/Laura-Pitko-1464576883611081/

INSTAGRAM: https://www.instagram.com/laura_pitko24/

DISCLAIMER: I (Laura Pitkute) am not a financial advisor, real estate broker, a licensed mortgage broker, not a certified financial planner, not a licensed attorney, and not a certified public accountant, therefore please consult with a competent professional prior to engaging in any financial strategies. Not everyone will experience 100% success rate by using this strategy as it requires a commitment to keep applying this strategy over time until the desired result is achieved. I (Laura Pitkute) do not promise or guarantee any specific outcomes and/or results from the use of this strategy.

Other Video about How to pay off a 30 year home mortgage in 5-7 years:

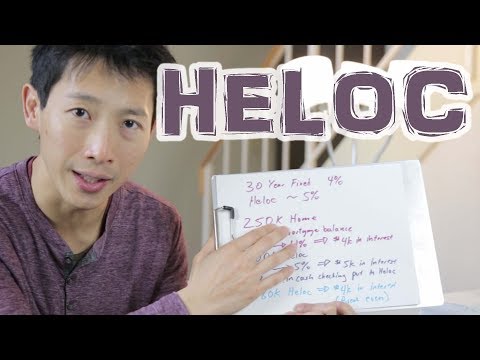

Should You Pay Off Your Mortgage Early with a HELOC?

You can use the equity in your home to get a home equity line of creditSubsequently, you can use the funds to pay of your mortgage early while then using the .

Home Mortgage/Equity/Heloc

Replace Your Mortgage Review: Elliot From Murfreesboro Pays Half His Home Off

In this Replace Your Mortgage review, Elliot shares how he leveraged the RYM strategy to pay off half of his home extremely quickly.and start using his line of .

Replace Your Mortgage Why Banks Don't Promote HELOC's As Much And $40,000 Case Study

In this video Michael Lush answers the question as to why this isn't as popular with banksThe answer might shock you

Also, Replace Your Mortgage Client Jay .

0 Comment