Breaking Mortgage. Mortgage Payout Penalty: 2 Ways Lenders Calculate the Interest Rate Differential (IRD)

Breaking Mortgage video duration 1 Minute(s) 10 Second(s), published by Capital Forever on 19 09 2019 - 23:49:09.

Should I break my mortgage contract? You may find that your current mortgage terms and conditions no longer meet your needs

What happens? When you In this educational series, Carrie Becker and Jessie Gill, Mortgage Partners from Traditions Mortgage in South Central PA, explain some common terms used in .

Confused about Mortgage terms? Brandon Brotsky helps homebuyers understand different mortgage terms such as APR, DTI, Appraisals, and More

Share this The Case Study we examine in this video focuses on a Mortgage via a Private Lender for Applicants that have a Bruised Credit History

Private Mortgages are If 2 lenders have the same mortgage rates offered for the same terms, which one is a better choice? On the surface everything may look the same, but open the .

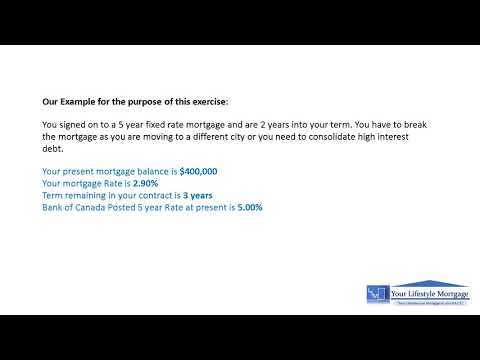

Should I break my mortgage contract? You may find that your current mortgage terms and conditions no longer meet your needs. What happens? When you renegotiate your mortgage contract, you break your old mortgage contract and replace it with a new one. What are the pros? Perhaps you want to take advantage of cheaper mortgage rates, paying your mortgage off early or move to a larger home. What are the cons? If your lender allows you to break your closed mortgage contract, you will usually have to pay a few fees such as a prepayment penalty, administration fee, appraisal and a fee to remove the charge on your current mortgage and register a new one.

Other Video about Breaking Mortgage:

North Vancouver Mortgage Case Study with a Private Lender

The Case Study we examine in this video focuses on a Mortgage via a Private Lender for Applicants that have a Bruised Credit HistoryPrivate Mortgages are .

Mortgage Payout Penalty: 2 Ways Lenders Calculate the Interest Rate Differential (IRD)

If 2 lenders have the same mortgage rates offered for the same terms, which one is a better choice? On the surface everything may look the same, but open the .

Mortgage Lingo 101 - APR

In this educational series, Carrie Becker and Jessie Gill, Mortgage Partners from Traditions Mortgage in South Central PA, explain some common terms used in .

Mortgage Glossary

Confused about Mortgage terms? Brandon Brotsky helps homebuyers understand different mortgage terms such as APR, DTI, Appraisals, and MoreShare this .

0 Comment