Port Moody Mortgage Case Study with a Private Lender. Mortgage Training

Port Moody Mortgage Case Study with a Private Lender video duration 1 Minute(s) 21 Second(s), published by Yiannis Andreou on 10 08 2019 - 22:04:34.

The Case Study we examine in this video focuses on a Mortgage via a Private Lender for Applicants that have a Bruised Credit History

Private Mortgages are What is this Mortgage Jargon.

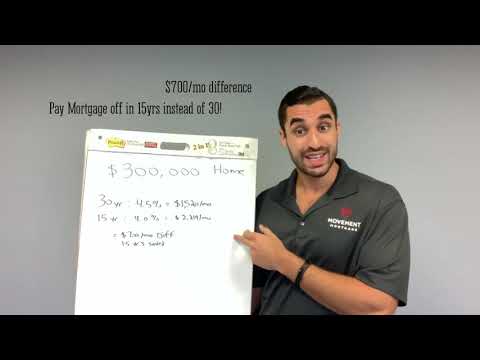

MORTGAGE MONDAY ✅ ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ “ONE Simple Trick That Could Save You SEVEN YEARS On Your Mortgage Term” 15-Year Fixed-Rate Versus 30 Year Fixed-Rate Mortgage Comparisons Of the two mortgage term options is the 15-year fixed rate mortgage or 30-year fixed rate

The Case Study we examine in this video focuses on a Mortgage via a Private Lender for Applicants that have a Bruised Credit History. Private Mortgages are useful because they are more flexible and easier to qualify compared to traditional Mortgages via a B or an A Lender. Debt ratios usually do not apply to Private Mortgages as long as the Applicants have strong and reasonable income. Rates on Private Mortgages range from 6% to 18% depending on the Lender's position(1st, 2nd or 3rd), Location, Collateral, Income and Loan to Value. Private Lenders can provide 1st, 2nd and 3rd Mortgages on a case by case basis. Private Mortgages can be closed or fully open. Loan amounts range from $50,000 - 30 Million. Private Mortgages allow Applicants to purchase the property they like and rebuild the credit at the same time so that they qualify in 1-2 years with a B or an A Lender depending on much much work needs to be done to improve credit score and history. Credit Scores in Canada range from 300-900. A Private Lender can help with scores anywhere from 300-599+. The better an applicant's credit score and history the better the Mortgage Terms we can secure. The key elements examined in this example are the Purchase Price or Fair Market Value, Down Payment, Loan to Value, Interest Rate, Term, Monthly Payment, Credit Score, Credit History, Annual Income, Debt Ratios and the Exit Strategy. Downtown Vancouver Mortgage Case Study with a Private Lender

Other Video about Port Moody Mortgage Case Study with a Private Lender:

15-Year Fixed-Rate Versus 30 Year Fixed-Rate Mortgage Comparisons 2019

15-Year Fixed-Rate Versus 30 Year Fixed-Rate Mortgage Comparisons Of the two mortgage term options is the 15-year fixed rate mortgage or 30-year fixed rate .

Mortgage Training

Mortgage University - Mortgage Terminology

What is this Mortgage Jargon.

0 Comment