🔴Retirement Should I Pay off Mortgage When I Retire or Invest My Money. Pay Off Mortgage Early Or Invest?

🔴Retirement Should I Pay off Mortgage When I Retire or Invest My Money video duration 10 Minute(s) 2 Second(s), published by Wisdom Investor on 30 09 2018 - 14:15:36.

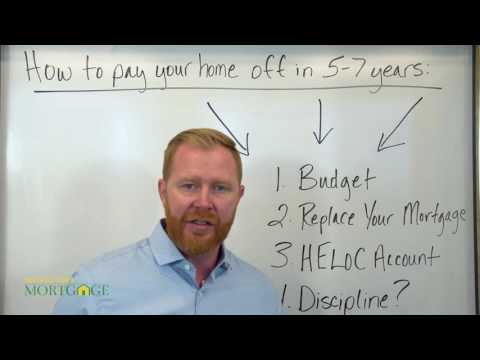

Retirement Age and Should I Pay off the Mortgage When I Retire and Invest My Money? I currently have home with mortgage balance of $130000 and the value Our book Replace Your Mortgage reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/get-free-holoc-guide Subscribe to our .

. . Get a FREE customized plan for your money

It only takes 3 minutes! http://bit.ly/2YTMuQM Visit the Dave Ramsey store today for resources to help you take .

Retirement Age and Should I Pay off the Mortgage When I Retire and Invest My Money?

I currently have home with mortgage balance of $130,000 and the value of the house is around 200,000. I'm paying a 4% interest rate, on a 30 year fix. My question Should I payoff the balance off or would it make sense to put this money to work in the market and attract additional income.

Positives of Paying off the Mortgage

1. Lower expenses in Retirement. Housing cost is one of the largest expenses in retirement.

2. Peace of Mind Factor increases.

3. Could Pay off the mortgage and sell house and move to lower cost area.

Negatives of Paying off the Mortgage.

1. Higher Housing Cost in Retirement.

2. Perhaps Less Peace of Mind since the Mortgage still has to be paid and not sure where the income will come from in the future since there is now job.

3. Lose Mortgage Interest and Tax deduction on Income Tax.

4. Less Cash in the Bank in the event of Emergency.

5. Investment Opportunity - The S&P 500 has been up 9.55% the past 15 years and up 13.82% the past 5 years. Double Edged Sword. Financial Markets may not grow as fast.

6. Do not want to use IRA to pay off mortgage. Penalty.

7. Binding up money in equity, which cannot be used.

In this case, we don't know how much cash the person has, but we can assume they may have at least $250,000 to pay off the $130,000 mortgage and have some left over.

If we assume they $250,000, after paying off the mortgage they would be left with $120,000. That takes a good chunk in the event they need additional money for emergencies or expenses down the road.

If we assume they have $1,000,000 dollars saved, then paying off $130,000 would only be a dent in their savings and there would be no home expenses in the future.

Other Video about 🔴Retirement Should I Pay off Mortgage When I Retire or Invest My Money:

Mortgage payoff

Pay Off Mortgage Early Or Invest?

Get a FREE customized plan for your moneyIt only takes 3 minutes! http://bit.ly/2YTMuQM Visit the Dave Ramsey store today for resources to help you take .

Replace Your Mortgage Simple Trick To Pay Off Home In 5-7 Years

Our book Replace Your Mortgage reveals how to pay off your home in 5-7 years on your current income: http://bit.ly/get-free-holoc-guide Subscribe to our .

0 Comment