Mortgage Moment Ep 010- Foreclosures, Short Sales, Auctions. 5 top free mortgage marketing ideas in 2019 for Loan officers

Mortgage Moment Ep 010- Foreclosures, Short Sales, Auctions video duration 5 Minute(s) 17 Second(s), published by Kit Crowne on 22 03 2019 - 14:38:50.

Foreclosures and Short-Sales and Auctions, Oh My! Tuck in to this video while I tackle tough topics to help you sort out whether these properties are a bargain or Are you or a loved one going through foreclosure? Are you tired of hearing from people who just want to take your money? Hire a professional

Let us help you .

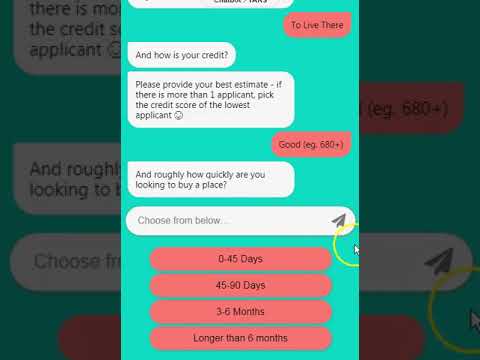

So easy to generate more qualified mortgage leads and sales faster through a chat platform!. York Real Estate Group Interviews Robert Slaughter, Mortgage Sales Manager, USbank There is a ton of sales and marketing information out there for loan officers - what is actually worth your time and what isn't? I've read numerous books, listened .

Foreclosures and Short-Sales and Auctions, Oh My! Tuck in to this video while I tackle tough topics to help you sort out whether these properties are a bargain or a boondoggle.

KitCrowne.com

Welcome to this week’s Mortgage Moments Video.

This week, I am continuing a 3-part series designed to help 1st time home buyers hit the ground running. Today, we’re going to talk about Foreclosures, Short-Sales, and Auctions.The key is to make sure that you understand just what you are getting into when you start down this path.

Foreclosures: Generally, this describes a property that has been repossessed by a bank and is being sold by the them, not the original owner. The bank, now that they are responsible for a property they really don’t want, is interested in just one thing: getting it off of their books as fast as possible and for as much as they can get their hands on quickly. They are very unlikely to make any repairs so these properties are typically marketed in “As-Is” condition. That means that the selling bank knows that the property needs some repairs in order for it to meet traditional financing standards. A quick note about properties that are being marketed as “Pre-foreclosure.” All this means is that the seller may lose the property in the near future but it’s still theirs to sell and that means you are dealing with the property owner, not the bank.

Short-Sales: A “Short-Sale” means that the seller is asking his lender to take less than is owed on the mortgage. There are a couple of things to know about these deals: first, since the seller won’t be getting anything from the sale, they no longer care what the home sells for. That means that they’ll accept an offer from just about anyone for just about any amount. However, it’s their lender who has the final word and the process of getting their approval on a short-sale can take months. Here’s why: if the bank decides that they can get back more of what they are owed by taking the property back – even after the costs of foreclosing and marketing the property – that’s what they are going to do. But, they aren’t going to tell you, the prospective buyer, a single thing about their intentions so, more often than not, the short-sale lingers and lingers and then suddenly, the property is taken by the bank. That can be very frustrating if you’ve been waiting forever expecting to hear when you will be closing. There’s another thing to know and that is that the seller is not likely to make any repairs to the property after inspections are completed. That’s partly because the seller doesn’t have any money and partly because they no longer care since it’s a zero-sum game for them. That means that you need to go into these deals with a true acceptance of the fact that these properties are being sold “as-is” and that you need to know that you have the money to make any needed updates or repairs. Finally, another popular type of listing is known as an Auction. It used to be that these were advertised-in-the-newspaper live events where you’d bring a bank check for 10% of the expected sale price and an auctioneer would literally call for bids and gavel a hammer. Nowadays, the majority of these are conducted online but the concepts are the same: you submit a bid and, if you’re the highest bidder, it’s yours. Most times, you have 30-days to close, there are no financing contingencies, no subject-to-inspection contingencies, and if you don’t close, your deposit is gone, gone, gone. But that’s the least of it. You need to know that you are buying the property subject to any liens or attachments, you are buying it with any problems it has, and most of all, you may be buying it with the existing owner or tenant still living in it… and evicting them is your problem. I am not saying that every auction is a bad proposition because that’s not the case. What I am saying, though, is that you need to go into these with way more due diligence and caution to ensure that you don’t catch a tiger by the tail. That’s it for this week. Thanks for watching.

Other Video about Mortgage Moment Ep 010- Foreclosures, Short Sales, Auctions:

SWFL Real Estate Update"When Can You Lock In Your Mortgage Rate"

York Real Estate Group Interviews Robert Slaughter, Mortgage Sales Manager, USbank.

5 top free mortgage marketing ideas in 2019 for Loan officers

There is a ton of sales and marketing information out there for loan officers - what is actually worth your time and what isn't? I've read numerous books, listened .

Let us help you with a Mortgage Modification or Short Sale

Are you or a loved one going through foreclosure? Are you tired of hearing from people who just want to take your money? Hire a professionalLet us help you .

0 Comment